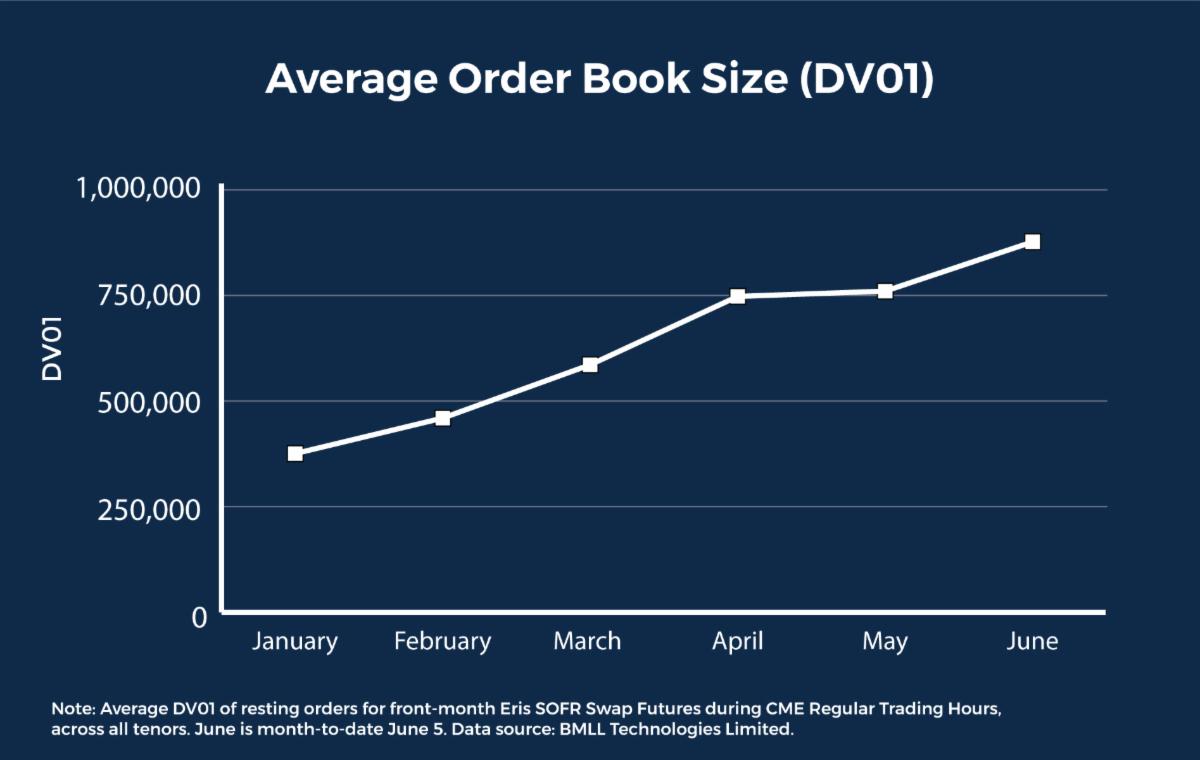

- Driven by capital efficiency improvements from CME’s late-Feb introduction of Portfolio Margining, Eris SOFR swap futures order book liquidity has grown tighter and deeper

- 10-year Eris SOFR has benefited most, with a 5X increase in quoted size and more than 50% reduction in average bid/ask spread since January

- 10y open interest increased to 19,776 contracts, recently setting trading volume records for roll and non-roll months

Date