Fees for Trading Eris Swap Futures

To trade CME’s Eris Swap Futures, a user must have an account with a Futures Clearing Merchant (FCM, or Broker) with Exchange Membership at CME Group. This allows the user to execute and hold positions in their account at their FCM.

CME Fee Schedules

Details of CME execution and clearing fees for Eris contracts may be found on CME’s fees page, as follows:

https://www.cmegroup.com/company/clearing-fees.html

Eris fees may be found in the links to “CBOT Fee Schedule” in the section titled “Financial Product Fee Schedules”.

Eris fees are outlined in the second to last column of this portion of the fee tables.

Execution and Clearing Fees

Fees incurred for trading Eris contracts may be broken into CME exchange fees and FCM fees.

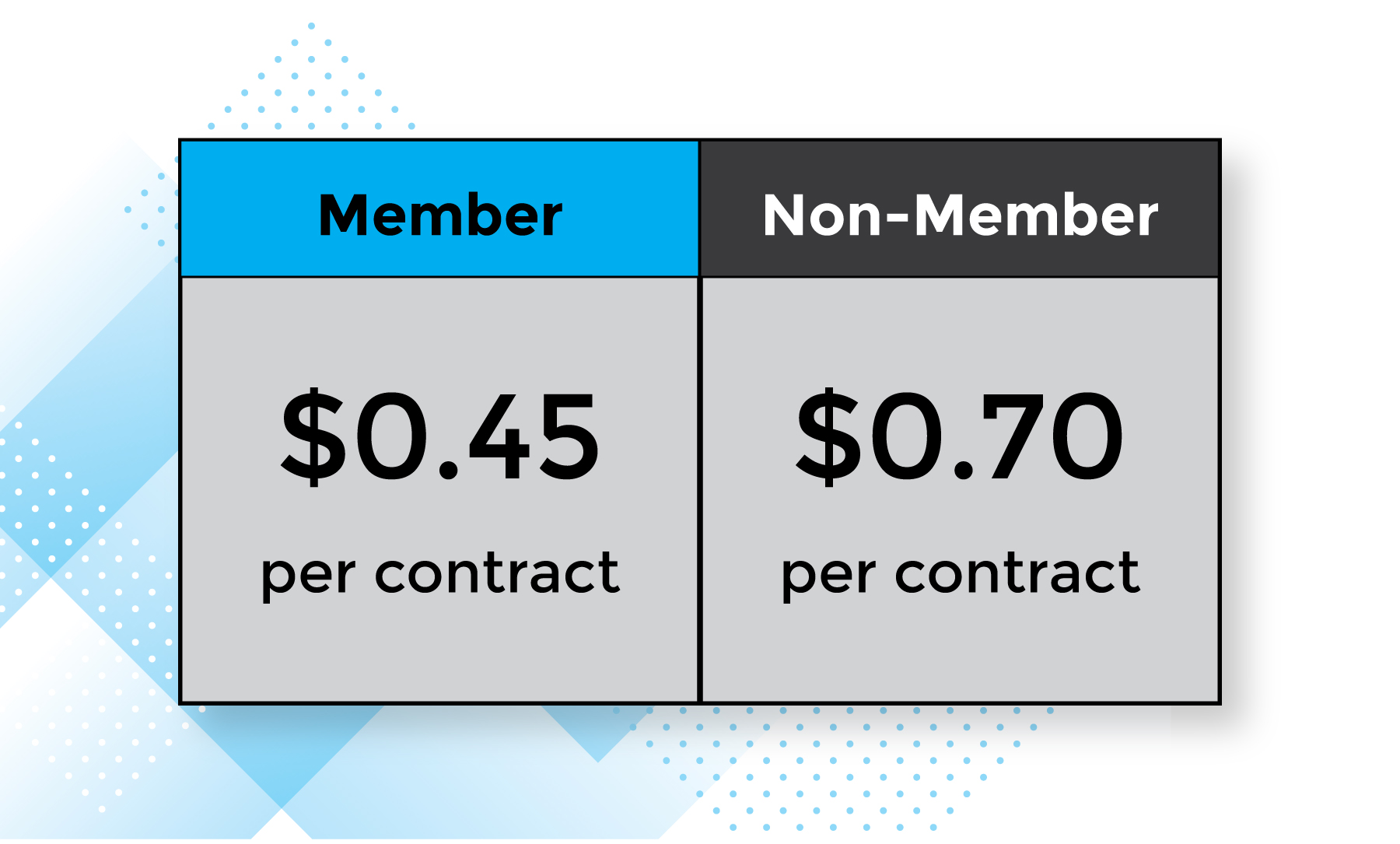

CME exchange fees vary according to whether the user has CME exchange membership, incentive plan or market making status, however, CME’s execution and clearing fees for Eris Swap Futures range from $0.45 per contract for exchange members, to $0.70 per contract for non-members.

Additionally, position holders will incur a maintenance fee of $1.00 per contract on each quarterly IMM date, on open positions in Eris contracts where the contract Effective Date is equal to, or prior to the IMM Date (i.e. no longer forward starting contracts, and commonly referred to as off-the-run positions).

FCM fees are separate to CME fees and are negotiated directly between the user and their FCM.

Block Fees

The passive market maker of privately negotiated trades in Eris contract will incur a surcharge, in addition to standard execution and clearing fees, depending on the final tenor of the Eris contract. The aggressor faces no surcharges. These surcharges are detailed in the Exchange Fees for Clearing & Trading section of CME website; click here and navigate to the latest CBOT fees schedule for full details.

CME collects Exchange Fees for Clearing and Trading from FCM members.

Maintenance Fees

CME Clearing assesses a quarterly per-contract Position Maintenance Fee (currently $1.00) for positions in Eris SOFR contracts that are off-the-run (i.e., on or after their Effective Dates), to support the on-going risk management activities required for long-dated futures contracts. CME Clearing collects Maintenance Fees via Clearing Firms, and calculates them based on positions held at the end-of-day on each of the four IMM dates (i.e., third Wednesday of March, June, September and December). For the avoidance of doubt, participants who roll their front-month positions quarterly (prior to the effective date) will not be subject to such fees.

Click here and navigate to the latest CBOT fees schedule for documentation details.