Trading swap spreads with Eris SOFR swap futures and Treasury futures as CME Globex inter-commodity spreads unlocks the benefits of liquid, anonymous, electronic futures markets.

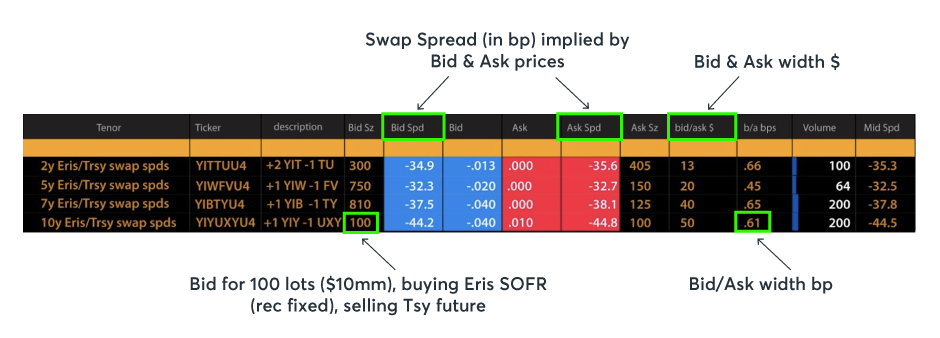

Available in tenors of two-, five-, seven- and 10-years, Eris/Treasury Swap Spreads offer single price negotiation in a central limit order book, with trades resulting in specific positions in each of the underlying futures contracts (Eris SOFR Swap futures and Treasury futures).

Markets for Eris/Treasury Swap Spreads are viewable on Bloomberg, Eris Innovations’ website, CME Direct and elsewhere. Prices are shown as “net change change on day,” such that a trade at zero (0.0000) results in each leg trading at its respective previous day settlement price. Market data on the Bloomberg Launchpad and Eris website include conversion of price to yield.

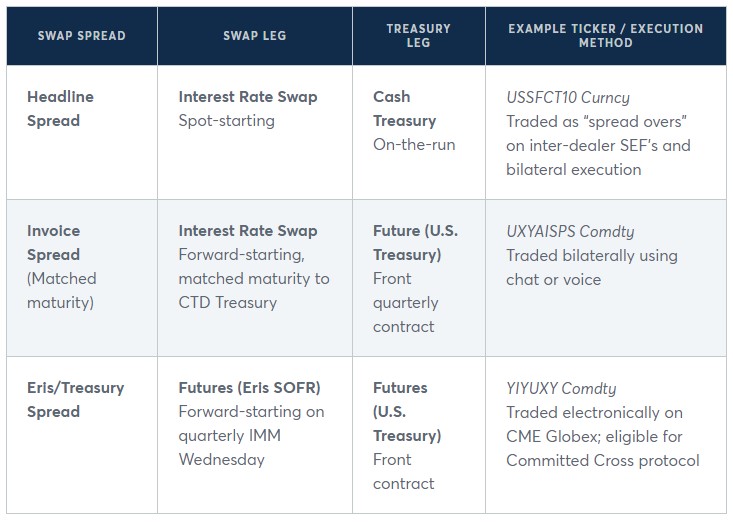

Like Headline Spreads and Invoice Spreads, Eris/Treasury Swap Spreads allow users to express a view on the market for swaps over treasuries. By uniquely utilizing electronically-executable futures for both legs of the swap spread trade, they allow market participants superior balance sheet efficiency and operational ease.

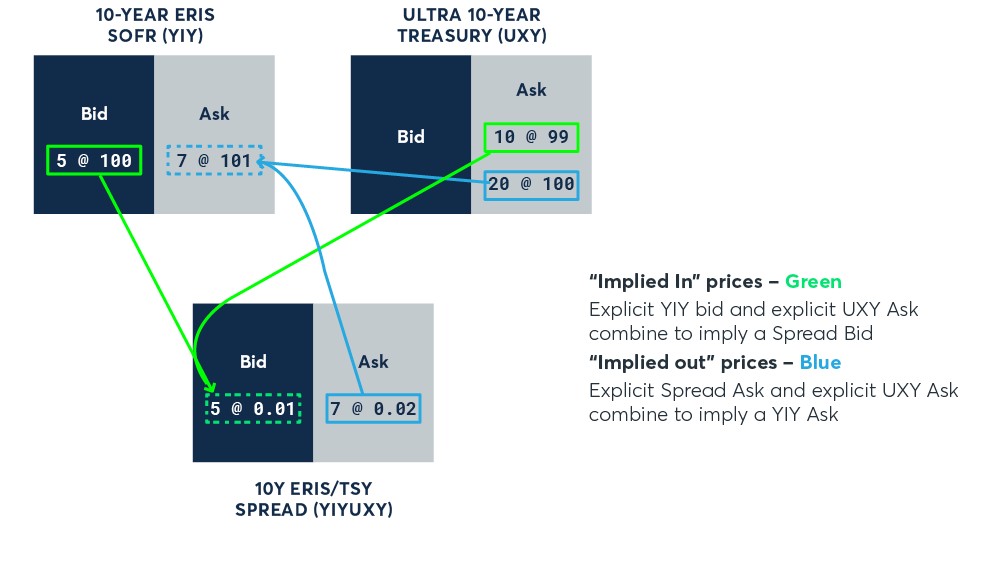

Eris/Treasury Swap Spreads benefit from CME Globex Price Implication functionality, which links Eris SOFR and Treasury futures markets to imply Eris/Treasury Swap Spread prices, and also implies outright orders in Eris SOFR and Treasury futures order books from quoted Eris/Treasury Swap Spread markets.

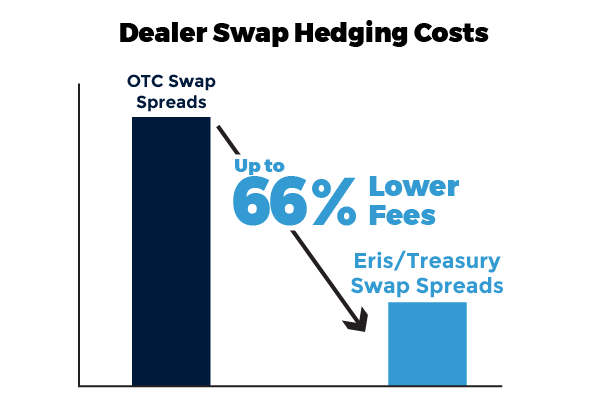

Dealers hedging swaps with CME Group futures can save up to 66% on fees for five-, seven- and 10-Year Eris/Treasury Swap Spreads, compared with traditional swap spreads on swap market venues.

Hedge funds, asset managers or other spread traders can use Eris/Treasury Swap Spreads to express a view on swap spreads without any information leakage or leaving footprints in the market

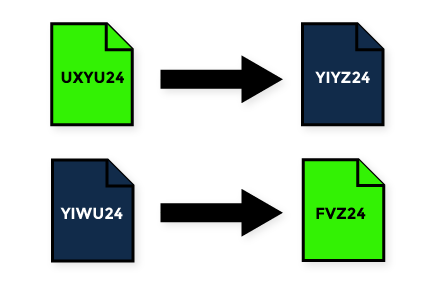

In addition to lead month contracts, Eris/Treasury Swap Spreads are also available in switch-and-roll combinations (e.g., this quarter’s Treasury futures vs. next quarter’s Eris SOFR), allowing users to switch between Treasury futures and Eris SOFR while simultaneously rolling to the next quarterly contract.